- Features

- Description

- Similar Items

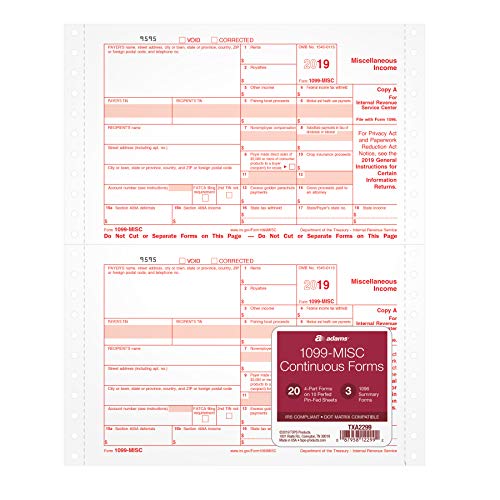

This forms kit from Adams gives you 20 carbonless 4-part 1099-misc forms on a continuous sheet with three 1096 summary reports

Continuous feed paper for dot matrix printers; carbonless for quick handwritten sets; our acid-free paper produces archivable results; Manufactured in the USA

You'll need form 1099-misc to report miscellaneous income other than wages, salaries and tips paid to Contract workers, Independent contractors and other non-employees

Adams forms have a machine-readable red ink copy a required by the irs for paper filing

Compatible with common tax software including Adams Tax Forms Helper Online-the quick and easy way to prepare Adams tax forms

Continuous feed paper for dot matrix printers; carbonless for quick handwritten sets; our acid-free paper produces archivable results; Manufactured in the USA

You'll need form 1099-misc to report miscellaneous income other than wages, salaries and tips paid to Contract workers, Independent contractors and other non-employees

Adams forms have a machine-readable red ink copy a required by the irs for paper filing

Compatible with common tax software including Adams Tax Forms Helper Online-the quick and easy way to prepare Adams tax forms

Binding:

Office ProductBrand:

AdamsEAN:

0087958122992Label:

TOPS ProductsManufacturer:

TOPS ProductsModel:

TXA2299Size:

Warranty:

N/AUse Adams 1099-MISC continuous tax forms to report income other than wages, salaries and tips paid to non-employees. This convenient pack includes 20 carbonless 4-part 1099 sets and 3 1096 summary transmittals for the internal revenue service. Includes machine-readable Red ink copy a forms required by the IRS for paper filing. (Be sure to avoid penalties imposed for filing plain black ink copies! ) our pin-fed forms are acid-free and archival safe for storage. Carbonless sheets create identical printed or handwritten sets with ease. 4-Part forms for 20 recipients. Inkjet/laser printer compatible. Tax software compatible.